How Much Life Insurance Do I Need? If you ask this question, you are far ahead of most people. Most clients who come to see me already have a figure in mind.

Let’s face it: Any figure over $100k sounds like a lot of money. How many of us see a chunk of change like this in one check? I’d say not many.

So, these figures can be deceiving.

The thing most clients forget is that this cash is going to have to replace an income PERMANENTLY.

This means that years down the road, your family will rely on this payout to keep the train on the tracks unless you replace it with some other source.

Let’s examine the process to clarify how much life insurance is ENOUGH.

My Name is James Heidebrecht & I’m An Independent Life Insurance Agent

…and the founder of Policy Architects. So, life insurance is my jam. Yep. I spend hours researching life insurance products and companies to give my clients the best rates for the most comprehensive policy.

But that’s not all. I maintain this blog to help people just like you do their homework BEFORE they sign on the dotted line.

One of the best reasons to work with a seasoned independent agent is to get personalized service.

Anyone can plug their details into an automated system and deal with the call center agent who receives their information. This is a hit-or-miss approach. Maybe you will get a kick-butt agent who knows insurance, OR maybe you will get a newbie who doesn’t know what they’re doing.

I have nothing against newbies; we all have to start somewhere. The thing is, unless you know something about life insurance, you are in their hands.

So, let’s get on with the show!

How Much Life Insurance Do I Need?

A Needs Analysis Will Help You Determine What Your Coverage Should Be

Being underinsured leaves your loved ones vulnerable. Remember, a life insurance policy covers your family for decades, so it’s a good idea to plan.

Most people request less coverage than they need. They fail to consider all their debts and the cash required to keep their family afloat long-term.

It’s so easy to underestimate needs.

To begin the process, you’ve got to ask yourself two questions:

Question #1: If I’m not here tomorrow, how much cash does my family need to stay in the same home, continue paying the identical bills (including the mortgage), and cover my kids’ college in the future?

The answer to this is different for everyone. Perhaps you don’t have children but are worried about your surviving spouse. Maybe you’re thinking about a business partner. Your kids could be older and on the cusp of going to university. Or, perhaps you’re a superhero taking care of an adult child with a disability… the list goes on.

Question #2: How long do my loved ones need the cash? 10 years, 15 years, 20 years, or even longer?

If you’ve just started a family, 25 or 30 years is an excellent place to start. Or maybe your kids are in their late teens and going to college in the next few years. In that case, your window of financial vulnerability may be more like ten years.

Perhaps you don’t have kids, but your spouse depends on your income to help pay the mortgage and other living expenses. How long do they need that help?

Get the idea?

So now that I’ve got you thinking about how much and for how long, there are two basic methods for determining the amount of life insurance you should buy.

How Much Life Insurance Do I Need – Rule of Thumb Method

I get it. Life insurance is important, but you’re busy with a lot on your plate.

One quick way to calculate how much life insurance you need is to multiply your GROSS salary by 10. For example, if you make $50k, you probably need at least $500k in coverage. If you have young kids at home, you need closer to fifteen times your salary to be on the safe side.

Rule of Thumb Example

Bilal is 35 years old, married, and has a 5-year-old son and an 8-year-old daughter at home. He’s an engineer earning roughly $100,000 per year. In addition to his $480,000 mortgage amortized over 25 years, he has $50,000 in his RRSP but no other significant debt.

If we apply the Rule of Thumb method, Bilal will require fifteen times his gross salary, $1,500,000 (15 X $100,000) in coverage because he has a young family.

How long does he need the protection? Option #1 – 20 Years

He figures at least 20 years, when his kids will be 25 and 28, respectively. A $1.5 million, 20-year term policy with RBC life insurance at standard, non-smoker rates will cost him $84.20 monthly. That sounds affordable, but what if he wants a longer term? After all, his mortgage has been amortized for over 25 years. A more extended period will give him more peace of mind.

Option #2 – 25 Years

An RBC $1.5 million 25-year term policy will set Bilal back $119.97 monthly. Hmmm, that’s a little more than he wants to spend. Is there another option? His insurance agent suggests he consider layering term coverage to save money. What does that look like?

Option #3 – 20 and 30 Years Combined

A $500,000, 25-year term policy combined with a $1,000,000, 20-year term policy will cost Bilal $96.12 monthly. That means he has 1.5 million dollars of coverage from age 35 to 55 and then $500,000 from age 56 to 60. Also, his monthly premiums will decrease to $45.86 for the last five policy years.

Bilal is happy with this option because he hoped to keep his life insurance costs under $100 monthly.

How Much Life Insurance Do I Need – Calculator Method

If you’re a numbers person like me, then this is the method for you.

We’re going to look at the following:

- The insured’s age and the age of any dependents

- Annual income and how much of it you want to leave for your loved ones

- Mortgage balance and amortization

- Other debt – credit cards, LOCs, car loans, etc.

- Post-secondary school costs for your kids

- Your assets – real estate, savings, registered and unregistered investments

The calculator method takes more time, but is it more accurate? Let’s find out.

Calculator Example

Let’s use Bilal again. Remember, he’s 35, married, and has a son and daughter, 5 and 8 years old, respectively. He earns $100,000 annually as an engineer and has a $480,000 mortgage amortized over 25 years. He has $50,000 in his TSFA and hopes to contribute more in the coming years.

Before we get into the calculation, we will ask Bilal a few questions.

What percentage of his gross salary does he want to leave behind for his family?

As an engineer, he’s very precise. Bilal wants to ensure that Jennifer and his kids continue receiving his net income yearly. After federal and provincial taxes, CPP contributions, and EI premiums are deducted from his $100k salary, he has approximately $72k of net income. That’s what he wants to leave behind for his family.

How many years does he want his family to receive this benefit?

Twenty years, he thinks, is adequate.

Does he want to leave extra money to pay for post-secondary education for his two children?

He figures $25,000 for four years for each child will do it. That’s $200,000 extra.

Applying the Calculator method, Bilal will need $1,590,000 of coverage to ensure his family receives his after-tax income for 20 years and has cash left for education. We also must consider that his TSFA will roll over to Jennifer, his wife.

How did I get that number? Let’s break it down…For simplicity’s sake, we’re going to forget about interest and indexing:

$72,000 (Bilal’s net income) X 20 years (benefit period) + $200,000 (kid’s college fund) – $50,000 (TFSA) = $1,590,000

Option #1 – 20 Year Plan

A $1,590,000, 20 year term policy with Empire Life at standard, non-smoker rates, will cost Bilal $91.79 per month. So with this method, he’s still under the $100 per month cap that he set.

NOTE* Regardless of your chosen method, the coverage must be affordable. It’s better to have reduced life insurance at the right price than too much at the wrong price!

How Long Does Life Insurance Last?

If something happens to Bilal, how long will his life $1.5 million insurance death benefit last his wife, Jennifer, and their two kids? Let’s take a look at a couple of basic scenarios. Bilal’s after-tax net income is approximately $72,000 or $6,000 monthly.

Basic Annuity

If Jennifer put the policy proceeds into an annuity and drew $6000 (Bilal’s net income) monthly, how long would it be before she ran out of money?

ANSWER: 20.83 Years!

We’re not considering inflation or any interest earned for simplicity’s sake.

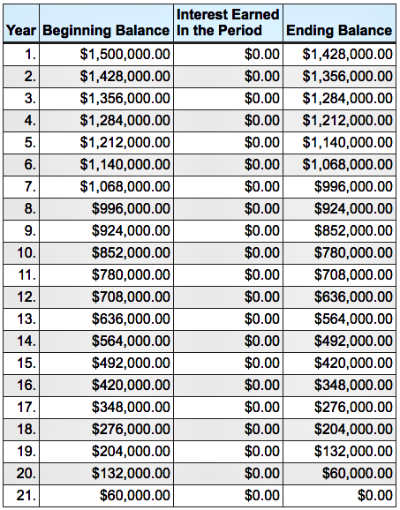

Looking at the payout calculation chart to the right, the “beginning balance” is $1.5 million, which is Bilal’s policy’s death benefit. The “ending balance” is reduced by $72,000, Bilal’s net annual income each year.

Moving down the chart, Jennifer draws $72,000 out of her account every year for 20 years. In the 21st year, she draws $60,000, and then the money is gone.

I don’t know about you, but a significant amount of income comes into Billal’s household for an extended period. While it can never make up for his loss, it does mean that his family will avoid financial devastation.

Life Insurance Policy Payout Calculator

Fully Indexed Payout

This time, when Jennifer invests the $1.5 million policy proceeds, it’s subject to the following conditions:

- 4% interest growth

- 2% inflation

- 25% average income tax rate – in reality, it wouldn’t be this high as Jennifer would only be taxed on the interest generated by the proceeds (column 5 in the illustration below)

So how long will it be before she runs out of money while drawing approximately $72,000, after-tax, indexed annually?

ANSWER: 23 Years!

If you check out the illustration below, you can see again the “beginning balance” is $1.5 million (the death benefit of Bilal’s policy). Each year, the “remaining capital to invest” is reduced by $72,453.93 (Bilal’s former net income). This figure is after a 25% income tax reduction.

The column on the right indicates interest earned (4%) on the remaining capital. In year 2, the “initial capital” is only reduced by approx. $30k even though Jennifer was paid out $72k in the first year. Also, notice that the “income required” amount increases yearly by 2% inflation.

Bottom line: Jennifer is paid out $72,453 present value, after-tax, every year for 23 years.

Fully Indexed Life Insurance Payout Calculation

Term Insurance Is Your Best Bet for Income Replacement

Now, I want to make this clear: We are talking about term life insurance right now. Term is the most affordable coverage available, which allows people to purchase more protection. But please remember that this type of policy provides a temporary safety net for your family for a defined period: 10, 20, or 30 years.

There is no guarantee they will receive a payout.

If you want coverage until the day you die, you need permanent life insurance, which I will not discuss here. This is because term insurance works for most people most of the time. Permanent insurance is much more expensive and nuanced so that I will save that for a different post.

How Much Life Insurance Do I Need?

Protecting Your Mortgage

When figuring out how much life insurance you need, you’ve likely been bombarded with information from agents and financial institutions telling you how important it is to protect your mortgage.

I’m here to tell you that focusing solely on protecting your mortgage is a mistake. If you think hard about it, “protecting your mortgage” should be “protecting your income.” After all, your income makes it possible for you to qualify for and pay your mortgage in the first place.

“INCOME PROTECTION = MORTGAGE PROTECTION”

Many banks or financial institutions that underwrite mortgages in Canada offer mortgage protection to their clients. They call it mortgage life insurance. I wouldn’t touch mortgage insurance sold through the bank with a ten-foot pole.

Please read my post to find out why personal life insurance trumps mortgage life insurance every time when it comes to protecting your home and income. It’s one of the most informative and in-depth online mortgage insurance articles.

Sometimes, Our Needs Change

Ugh, this is one of the biggest drawbacks of underinsuring yourself. Let’s say you get your life insurance when you are in your mid-30s.

You have no idea that your business will take off in your 40s and your salary will triple! This is GREAT for your family.

… but not so great for your life insurance coverage. That $500K policy you took out is now woefully inadequate. You’ve been working so hard that you have let your health slip. Unfortunately, you have some moderate medical issues.

If you decide to get more coverage, it will cost you a lot more because you no longer qualify for those sweet preferred rates—and you are now 10 years older. I am posting some basic numbers to show you how much more our client will pay for his insurance.

“At the time, we figured 30 years would bring us close to our retirement age and thus help cover any years where there was only one income to live on in the event one of us had died.

The term policy was much cheaper than a whole life policy, the death benefit amount ($1 million) was set, and we knew exactly how much we would be paying each month (or year) for the next 30 years.”

Example of How Age and Health Impact Your Rates

A 35-year-old male client with a preferred rating seeks $500K coverage for a 30-year term. His premiums are about $50.00.

If that same client is 45 with a standard rating, that coverage costs him about $152.00.

These are today’s rates, so I can’t look into the future for rates that are a decade away, and our client may need less coverage and a shorter term. However, these figures show how much more a client pays 10 years later with a reduced rating.

The last thing you want to do is wait until you are older and less healthy to buy more coverage. My best advice is to max out what you can afford. The beauty of term life insurance is that it’s super flexible, and if you no longer need it, you can drop it.

Layering Your Life Insurance

Another tactic you can use to ensure you have enough coverage without overdoing it is to layer your policies.

So, you would sit down with your independent life insurance agent and plan how you see paying down your mortgage and taking on debt. We would then ensure you have multiple policies that create coverage that drops off as your debts drop.

For example, you would hold the most coverage during your most vulnerable years, and then as your needs dwindle, your policies would end, making your life insurance burden less costly.

Is $1 Million of Life Insurance CRAZY?

When people hear $1 million of coverage, they think it’s a crazy figure. It’s not, especially if you live in a big city like Toronto, Montreal, or Vancouver, where a house can cost a million plus.

As I mentioned above, you should have at least ten times your gross salary, but many of my clients opt for more (up to 15 times) because it provides wiggle room.

So, let’s say you make $80K per year and have a $500K mortgage. I recommend at least $1 million in coverage to allow your beneficiaries to continue as usual.

Do NOT Forget About You Children’s Education

The above information allows your family to live their life now. It does not provide much cash for continued education.

I suggest adding at least $100K of coverage per child if you want enough cash. This helps you foot these expenses; chances are you will need this help if you’re a single parent. Education is very costly.

Don’t Forget A Stay At Home Parents TIME is Valuable

One big mistake many clients make is underestimating the value of a stay-at-home parent. They skimp on coverage in this area because they don’t attach an income.

This is a real problem because what a stay-at-home parent offers cannot be replaced, and even when you do get someone to pick up some of the pieces, it costs a pretty penny.

To put it into perspective, let’s say you have two kids. You work full-time, and your partner takes care of them. If they die of cancer this year and you employ a Nanny to help you with dinners and taking the kids to and from school, it’s going to cost some serious cash.

Your kids are 5 and 7, so you will likely need help until your youngest turns 14 or 15, which is nearly a decade of service. You find an excellent nanny, and she wants $55K per year to provide full-time help.

Her services will cost you over $500K for that period. OUCH.

Please give your stay-at-home partners their due date. They provide a lot more than you’ll ever know.

How Much Life Insurance Do I Need? Find Out By Calling Policy Architects Today

How Much Life Insurance Do I Need? Well, I could provide a bunch of fancy calculators that you can use to calculate your debt, income, and goals, OR I could tell you to schedule a call with Policy Architects.

There’s a lot more we can discuss on a call than you can by playing with some meaningless numbers. Most people need an outside perspective to get real. It’s much easier to fool yourself than to fool an agent.

If it looks like you are fudging some numbers, we will set you straight. It also helps to discuss goals so we can formulate a customized plan for your future.

Not all life insurance companies are created equal, and many products must be considered.

While I can give you a basic heads-up about 10xing your gross salary and some tips to help you get adequate insurance, you need more details.

Give us a call today. We can help you find the perfect policy for your family.

Fact Checked

Fact Checked